Medical Expense Protection Plan

Accidents and unexpected illnesses can happen to anyone—but you don’t have to face them alone. With the Medical Expense Protection Plan designed specifically for BLET Members and their families, you’ll receive lump sum tax-free benefits, paid directly to BLET Members, Spouses, Children / Dependents when injured in an accident or diagnosed with major critical illnesses. This coverage provides financial peace of mind so you can focus on recovery, not expenses.

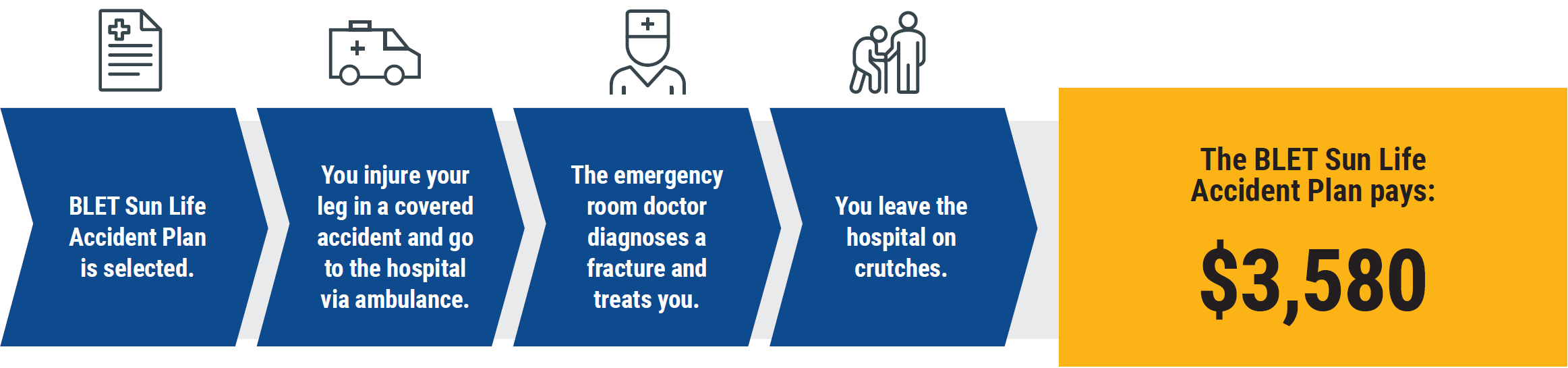

Accident Coverage

Guaranteed Approved Coverage: No medical questions or tests for actively working Members.

Coverage available to Member, Spouse and Children / Dependents.

Lump sum benefits paid when an accident occurs.

$50,000 of AD&D Coverage.

Coverage is 24/7 on and off the job.

Wellness Benefit- $50 per covered person per year.

No pre-existing limitations.

Does not offset against any other benefits.

Benefits paid for covered injuries and medical services resulting from an accident.

No limit on number of claims that can be filed.

| COVERAGES | MONTHLY COSTS | ||||||||||||||||

| Members / Officers | $17.77 | ||||||||||||||||

| Members / Officers & Spouse | $26.23 | ||||||||||||||||

| Members / Officers & Children / Dependent(s) | $30.36 | ||||||||||||||||

| Family | $38.82 | ||||||||||||||||

Injuries

Examples of covered injuries resulting from an accident include:

Burns

Coma

Dislocations

Eye Injury

Fractures

Muscle

Lacerations

Concussion

Ligament / Tendon

Services

Examples of services resulting from an accident include:

Ambulance

ER Visits

Hospital Admission

Hospital Confinement

Major Diagnostic Testing

Medical Devices

Physical Therapy

Surgery

X-rays / MRI’s

Doctor Visits

Blood Transfusion

Hospital Confinement

Guaranteed Approved Coverage: No medical questions or tests for actively working Members.

Pays cash benefits to use however you want.

Coverage available to Member, Spouse, and Dependents.

Benefits are payable for hospital stays due to: Sickness, Accidents, Complications of pregnancy, Newborn complications, Mental and nervous disorders, and Substance abuse.

Benefits add up - many of your benefits can all be payable on the same day.

We are offering a choice of two plans: a Low Plan and a High Plan - choose the one that best fits you and your family’s needs.

| BENEFITS | LOW PLAN | HIGH PLAN | ||||||||||||||||||

| First Day Hospital Confinement This benefit pays the first day you stay in a regular hospital bed. |

$1,000 Per Day 1 day |

$2,000 Per Day 1 day |

||||||||||||||||||

| Hospital Confinement This benefit pays for a hospital stay in a standard room. Payable in addition to: – First Day Hospital Confinement |

$100 Per Day Up to 30 days |

$200 Per Day Up to 30 days |

||||||||||||||||||

| Intensive Care Unit (ICU) Confinement This benefit pays for a hospital ICU. Payable in addition to: – First Day Hospital Confinement – Hospital Confinement |

$100 Per Day Up to 10 days |

$200 Per Day Up to 10 days |

||||||||||||||||||

| Extended Hospitalization Benefit This additional benefit pays after 10 total days in a row of confinement beginning with your first day in a regular hospital room or the ICU. |

$100 Per Day 30 day max per benefit year |

$200 Per Day 30 day max per benefit year |

||||||||||||||||||

| Wellness Screening Benefit This benefit pays for a covered wellness test or exam even without a hospital stay. |

$50 Per Day 1 day per insured per benefit year |

$50 Per Day 1 day per insured per benefit year |

||||||||||||||||||

| MONTHLY PREMIUM | LOW PLAN | HIGH PLAN | ||||||||||||||||||

| MEMBER | $17.26 | $31.98 | ||||||||||||||||||

| MEMBER & SPOUSE | $34.90 | $65.66 | ||||||||||||||||||

| MEMBER & DEPENDENT(S) | $30.03 | $56.51 | ||||||||||||||||||

| FAMILY | $47.67 | $90.19 | ||||||||||||||||||

How does Hospital Confinement work?

Amount payable was generated based on benefit amounts for: First Day Hospital Confinement ($2,000) + Hospital Confinement for 12 days ($200 per day for a total of $2,400) + ICU Confinement for 3 days ($200 per day for a total of $600) + Extended Hospitalization for 12 days ($200 per day for a total of $2,400).

Critical Illness Coverage

Guaranteed Approved Coverage: No medical questions or tests for actively working Members.

Coverage available to Member, Spouse and Children / Dependents.

Lump sum benefits paid when diagnosed with a covered critical illness.

Member coverage available up to $40,000 in $10,000 increments.

Spouse coverage available up to $40,000 in $5,000 increments.

Dependents automatically covered at 50% of Member election at no additional cost.

Wellness Benefit- $100 per covered person per year.

Pre-existing conditions are covered Day 1 as long as it is a new occurrence of the illness.

Monthly cost never changes—you can take coverage with you after you retire.

| COVERAGES | MONTHLY COSTS BY AGE BRACKET | |||||||||||||||||||

| MAX BENEFIT* | <30 | 30-39 | 40-49 | 50-59 | 60-69 | |||||||||||||||

| $10,000 | $6.57 | $9.47 | $16.47 | $30.27 | $55.27 | |||||||||||||||

| $20,000 | $10.62 | $16.42 | $30.42 | $58.02 | $108.02 | |||||||||||||||

| $30,000 | $14.67 | $23.37 | $44.37 | $85.77 | $160.77 | |||||||||||||||

| $40,000 | $18.72 | $30.32 | $58.32 | $113.52 | $213.52 | |||||||||||||||

*For additional benefit amounts not shown, please call (224) 487-5030.

Examples of critical illnesses include:

Heart Attack

Stroke

Coronary Artery Disease

Invasive Cancer

Non-Invasive Cancer

Skin Cancer

Major Organ Failure

Severe Burns

End-stage Kidney Failure

Type 1 Diabetes

Multiple Sclerosis

Paralysis

Coma

ALS

Important information about Accident Coverage, Hospital Confinement, and Critical Illness Coverage

This program is voluntary and it is solely the Members’ decision to enroll. Members are responsible for paying their own costs. The BLET does not make any endorsement or recommendations regarding these benefits. Please note that coverage is for BLET Members, officers and employees only. This is a basic summary of benefits and makes no guarantee or warranty on the processing of claims. In order to be eligible for benefits at time of claim, you must be an active Member, officer or employee of the BLET or retired from the BLET. Other limitations may apply. It is the responsibility of each enrolled Member to obtain a copy and read the entire policy booklet. You may request a copy of the policy booklet by email to info@unionone.com. All non-banking administrative and transaction fees are included in the enclosed costs. For more detailed information visit www.bletvip.com/ci-acc. Email at info@unionone.com.

IMPORTANT: If you leave the union for any reason other than retirement, you are no longer eligible for coverage and it is your responsibility to contact our office immediately at (224) 770-5307. Failure to do so within 90 days will postpone your ability to receive a refund.

![]()

Important information about this plan

IMPORTANT: The monthly cost for coverage is based on your age at the start of the coverage and will increase on the policy anniversary date after you move into a new age bracket.

Participation in this program is voluntary, and the decision to enroll rests solely with the Members. Members are responsible for bearing all associated costs. A $3 technology fee is included in all listed monthly costs for the following coverages: Short-Term Disability and Long-Term Disability. A $2 technology fee is included in all listed monthly costs for the following coverages: Member Life and Spouse Life.

This voluntary benefit plan is classified as a Safe Harbor plan and, as such, is not subject to the Employee Retirement Income Security Act of 1974 (ERISA). The BLET does not contribute to the premiums for this plan on behalf of its Members, does not endorse the plan, and does not require Members to enroll in the plan.

IMPORTANT: If you leave the union or retire, it is your responsibility to contact our office immediately at (224) 770-5307. Failure to do so within 90 days will forfeit your ability to keep coverage and receive any refunds.

We encourage Members to thoroughly review the complete policy booklet. Email info@unionone.com to request a copy.

This program is administered by Union One Benefits Administration.

FOR AD&D, STD & LTD: THIS IS AN EXCEPTED BENEFITS POLICY. IT PROVIDES COVERAGE ONLY FOR THE LIMITED BENEFITS OR SERVICES SPECIFIED IN THE POLICY.

For STD & LTD: These policies provide disability income insurance only and do NOT provide basic hospital, basic medical, or major medical insurance as defined by the New York State Department of Financial Services.

For Life: You have 31 days to notify Union One of your retirement if you wish to port or convert your Life Insurance.

North Carolina Residents: THIS IS NOT A MEDICARE SUPPLEMENT PLAN. If you are eligible for Medicare, review the Guide to Health Insurance for People with Medicare, which is available from the company.

Group Insurance coverages are issued by The Prudential Insurance Company of America, a Prudential Financial company, Newark, NJ. The Booklet-Certificate contains all details, including any policy exclusions, limitations, and restrictions, which may apply. Contract Series: 83500.

Prudential, the Prudential logo, and the Rock symbol are service marks of Prudential Financial, Inc. and its related entities, registered in many jurisdictions worldwide.